Welcome to Credit Agricole.

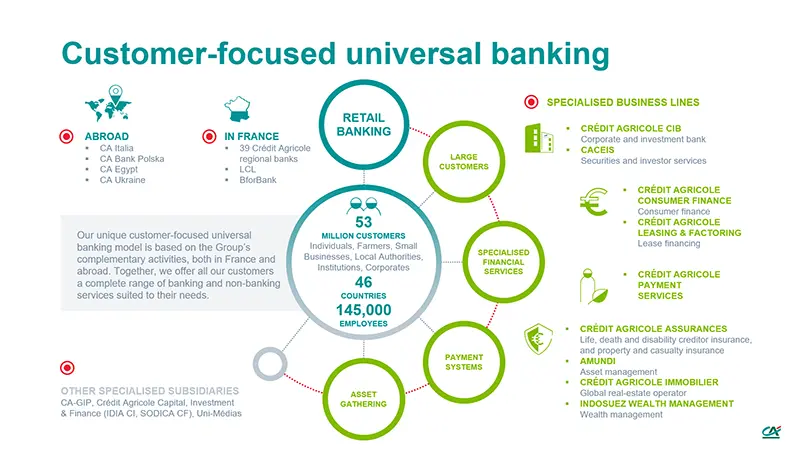

We are a universal bank that has been present in the Polish market for over 20 years and is one of the most commonly recommended bank in Poland. We offer banking services to retail customers and corporations, to farmers and small and medium-sized enterprises, as well as consumer finance services. We are part of the Credit Agricole Group - the 10th largest financial group in the world, operating in 46 countries worldwide and every day providing services to more than 53 million customers.

Our raison d'etre, and our motto, is: ‘Working every day in the interest of our customers and society’. This means that the customer is at the centre of our attention: we listen carefully to our customers and deliver the solutions they need.

Credit Agricole offers you daily banking services (current and fixed-term deposit accounts, cards) and almost every type of loan. Our leasing, factoring, corporate and investment banking experts will be happy to help you whether you are an individual, an SME, a big international corporate client, a farmer or an agribusiness client.

We are not limited to just financial services, we also offer a wide range of insurance products: motor, property, and life insurance. We have vast experience in the consumer finance market. Our hire purchase loans, known under the CA Raty brand, are available at nearly 12,000 points of sale throughout Poland.

We are a modern, people-centred bank. We are investing in new technologies and making our services more easily accessible via remote channels, but at the same time we care about our staff and about the quality of our face-to-face customer service. Our services and products are easy to use: they are available, at any time, via our CA24 mobile application and online banking. Our customers can join the Benefit Club, the biggest discount programme in Poland with nearly 10,000 shops and stores offering discounts for payments made with our cards.

We also have a network of more than 400 branches in prime locations in all the major towns and cities in Poland. Our professional and friendly staff are always happy to help you with anything you may need.

See you soon!

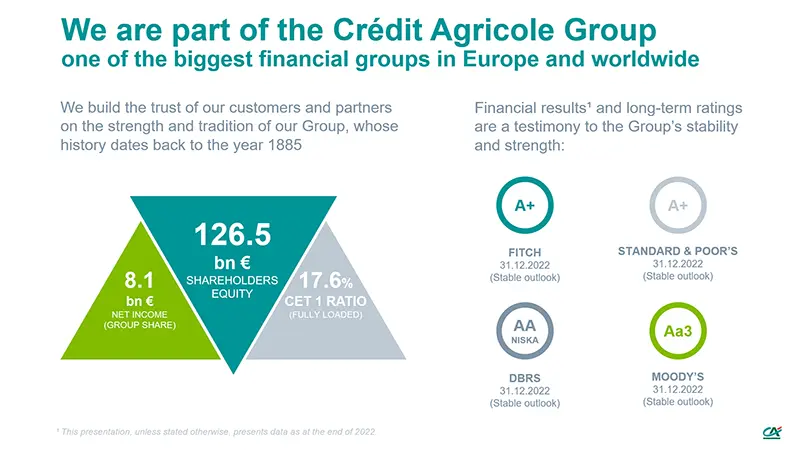

We have been part of the Crédit Agricole Group since 2001. Our French parent company is proud of its history spanning over 130 years. It is now one of the world’s top 10 banks by assets. It is also the largest European retail bank and the leading insurer in France. The Crédit Agricole Group is present in 46 countries around the world, serving the financial needs of 53 million customers.

The Crédit Agricole Group pursues a unique customer-focused retail banking model based on cooperation between retail banks and complementary specialist business lines. This allows the Group to offer its customers a full range of banking and non-banking products and services, such as insurance, real estate, payments, asset management, leasing and factoring, consumer finance, as well as corporate and investment banking, as needed by the customers, in all distribution channels.

You can read more about the Crédit Agricole Group HERE.

Management Board of Credit Agricole Bank Polska S.A.

| Piotr Kwiatkowski has been working for Credit Agricole since 2007. Piotr Kwiatkowski is the President of the Management Board of Credit Agricole Bank Polska responsible for Internal Audit Department, Legal Department and Corporate Affairs Office, Compliance Department, Macroeconomic Analysis Department, General Services Department. From 2013 he was Vice-President in charge of, among others, corporate banking, investment banking, capital markets and macroeconomic analyses. Earlier, he was CEO of Credit Agricole Corporate and Investment Bank in Poland. He was also a member of the Supervisory Board of Credit Agricole Bank Polska. He has worked in the banking sector for more than 20 years; during his career he was director of loans office at Bank Handlowy (now Citi Handlowy), he also managed, among other things, the structured and trade finance department and the strategic corporate client segment at Pekao S.A. Mr Kwiatkowski holds Master’s degrees from the Warsaw University of Technology and the University of Warsaw as well as a PhD degree in economics from the Warsaw School of Economics. He also has a number of publications to his name on banking and finance, including in particular investment project financing, syndicated loans and credit risk assessment and management. |

| Mr Bernard Muselet brings over 30 years’ experience in finance. He joined the Credit Agricole Group in 2008 as Vice-President of Leasing & Factoring, responsible for the development of the business line in France and in international markets. He then pursued his career as the Deputy General Director of the Credit Agricole Ille-et-Vilaine Regional Bank. In 2019-2022, he was the President of the Management Board of Crédit du Maroc, where he was responsible, among others, for the digital and technological transformation and sales network development. In 2013-2015, he was also a member of the Supervisory Board of EFL, a leasing company, and one of the initiators of opening of the factoring business line at the EFL Group. |

| Beata Janczur is in LUKAS Bank since 2007 as Executive Director for HR and HR coordinator for CA Polska. Before joining LUKAS Bank Beata has been associated with ING Group in its Russian, Dutch and Polish structures. In ING Life Insurance Moscow Beata worked out and implemented a green field project in HR support and sales force development, while in Holland she was responsible for Development Programmes for TOP200 and projects on Engagement and Diversity, Organizational Culture for High Performance implemented worldwide. She acted as Human Resources Director in ING Nationale Nederlanden in Poland, managing HR division. Beata Janczur graduated Psychology Institute on Uniwersytet Jagieloński. |

| Philippe Enjalbal has been working in banking for 30 years, 18 of which he has spent at the Credit Agricole Group. Recently he acted as Chief Operational Officer for Credit Agricole Egypt. Before that, he held a similar position with Banque Saudi Fransi in Saudi Arabia, as well as Crédit Agricole CIB in Singapore and Prague. During this time he gained extensive international experience in areas such as IT, operations, administration and logistics (purchasing and real estate management, physical security and information security). Philippe Enjalbal graduated from École Nationale Supérieure de Mécanique et des Microtechniques. |

| Jędrzej Marciniak boasts over 20 years of experience in banking. His professional career developed in Wielkopolski Bank Kredytowy and, following the merger, in Bank Zachodni WBK. During that time he performed a number of functions at various management levels in Poland and abroad. In Wielkopolski Bank Kredytowy he launched the first electronic banking service in Poland and one of the first credit cards. During the merger of Bank Zachodni and Wielkopolski Banki Kredytowy, on the position of a management board member, Mr Marciniak was responsible for the consolidation of electronic banking systems and card business. He also supervised the creation of the call centre and payment card acceptance centre. From 2003 he was a managing director in charge of brand management and investor relations. He participated in the creation of a number of marketing campaigns including, among others, Arka investment funds and BZ WBK featuring international celebrities. During the period when Jędrzej Marciniak managed the BZ WBK brand, it became one of the most recognizable brands on the Polish market. |

| Bartłomiej Posnow has nearly 20 years’ experience in banking and consulting services for financial institutions. In 2015-2017, at Bain & Company, he managed strategy consulting projects for banking sector and private equity clients in Central Europe. Earlier he performed various managerial roles at Polbank EFG and Raiffeisen Bank; he was, among others, bank director and director of retail credit risk management department. During his career he also worked for Citi Bank Handlowy, BNP Paribas, and PwC. |

| Damian Ragan has worked in the banking sector for over twenty years. His last post was with Ukraine’s Kredobank, a subsidiary of PKO BP, where he was first vice-president of the management board. Before that, he managed, among other organisations, the sales network of Nordea Bank and the distribution network at BPH bank. His professional career, which began at Pekao SA, has always been connected with sales. Damian Ragan studied business, graduating from SGH Warsaw School of Economics, and he completed the Executive MBA programme at Warsaw University of Technology and post-graduate studies at the University of Colorado. He has also completed a number of international training programmes in management and banking, including at London Business School. |

Supervisory Board of Credit Agricole Bank Polska S.A.

- Michel Le Masson - Chairman of the Supervisory Board

- Olivier Guilhamon – Vice-Chairman of the Supervisory Board

- Serge Magdeleine - Member of the Supervisory Board

- Elżbieta Jarzeńska-Martin - Member of the Supervisory Board

- Liliana Anam - Member of the Supervisory Board

- Jarosław Myjak - Member of the Supervisory Board

- Barbara Misterska-Dragan - Member of the Supervisory Board

- Veronique Faujour - Member of the Supervisory Board

- Olivier Desportes - Member of the Supervisory Board

Management Board of Credit Agricole Polska SA

- Bernard Muselet - President of the Management Board

Supervisory Board of Credit Agricole Polska SA

- Veronique Maire - Chairman of the Supervisory Board

- Patricia Moreau - Member of the Supervisory Board

- Eve Duret - Member of the Supervisory Board

- Non-financial statement of Credit Agricole Bank Polska S.A. for the financial year ended December 31, 2018

1 MB

- Responsible business report of Credit Agricole Bank Polska S.A. 2019

3 MB

- Responsible business report of Credit Agricole Bank Polska S.A. 2018

29 MB

- Financial statements of Credit Agricole Bank Polska S.A. - 2018

149 kB

- Financial statements of Credit Agricole Bank Polska S.A. - 2017

144 kB

- Non-financial statement of Credit Agricole Bank Polska S.A. for the financial year ended December 31, 2017

421 kB

- Annual Report 2016 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A.

4,5 MB

- Annual Report 2015 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A.

5 MB

- Annual Report 2014 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A.

2,5 MB

- Annual Report 2013 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A.

2,5 MB

- Annual Report 2012 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A.

2,5 MB

- Annual Report 2011 - Credit Agricole Bank Polska S.A. and Credit Agricole Polska S.A

3 MB

- Annual Report 2010 - LUKAS Bank SA and LUKAS SA

1 MB

- Annual Report 2008 - LUKAS Bank SA and LUKAS SA

5,5 MB

- Annual Report 2007 - LUKAS Bank SA and LUKAS SA

3 MB

- Annual Report 2006 - LUKAS Bank SA and LUKAS SA.

1 MB

- Annual Report 2005 - LUKAS Bank SA and LUKAS SA

1 MB

- Annual Report 2004 - LUKAS Bank SA and LUKAS SA

3,2 MB

- Annual Report 2003 - LUKAS Bank SA and LUKAS SA

1,4 MB

- Annual Report 2002 - LUKAS Bank SA and LUKAS SA

3 MB

- Annual Report 2001 - LUKAS Bank SA and LUKAS SA

600 kB

If you are interested to read about our bank’s corporate sustainability and ESG performance, please check out our latest Responsible Business Report. Our report for 2022 is available HERE.

Ethical principles

At Credit Agricole, we observe applicable laws and regulations, as well as our internal regulations and standards that stem, among other things, from good practices for the banking sector and regulatory recommendations. The principles that we follow in our day-to-day work are described in the following documents:

- Code of Ethics of Credit Agricole Bank Polska S.A.

- Card of Ethics Credit Agricole Group

- Code of Conduct of the Credit Agricole Group

These documents reflect the key principles and values that form a coherent system of ethical norms to be followed by all staff of the bank, including members of its governing bodies.

One of our goals is to ensure that our relationships with business partners are based on a shared system of values and that we all promote socially responsible and ethical business practices. Therefore, we have also adopted:

Our approach

In our corporate sustainability efforts, we are guided by Paolo Taticchi and Melissa Demartini’s definition, which says that corporate sustainability is an integral approach to business aimed at enhancing competitive positioning and profitability through the sustained creation of shared value, co-creation practices with stakeholders and the integration of ESG factors in decision-making.

At our bank, we see corporate sustainability and ESG as an integral part of all areas of our operations and as running our business in a way that takes into account the expectations, impacts, and needs of all stakeholders in the bank’s entire value chain.

We see corporate sustainability and ESG as a mindset to earn profits ethically and responsibly, embedded in the day-to-day practice of each employee.

Our strategy

Our corporate sustainability and ESG strategy is part of the bank's business strategy.

Our strategic objectives are as follows:

- Acting for the climate and the transition to a low carbon economy;

- Strengthening social cohesion and inclusion.

| Acting for the climate and the transition to a low carbon economy | Strengthening social cohesion and inclusion |

|---|---|

| E1 Reduce carbon footprint of our own activity and our financing portfolio | E4 Offer a range of products and services for customers with diverse needs |

| E2 Offer our customers support in ESG | E5 Integrate young people through employment, training and access to financing |

| E3 Incorporate ESG criteria into our financing approach for Corpo, SOHO and Agri clients | E6 Improve customers’ knowledge of finance management and prevent customer over-indebtedness |

| #actingfortheclimate #lowcarboneconomy #greenbanking | #socialcohesion #socialinclusion |

In the implementation of our corporate sustainability and ESG strategy, we are supported by FReD, a tool provided by the CA Group.

FReD is based on three pillars:

- FIDES, which comprises compliance projects aimed at improving the transparency of our conduct vis-a-vis customers, and thus at strengthening trust;

- RESPECT, which comprises HR projects related to our commitments to staff, to the benefit of society;

- DEMETER, which comprises our initiatives focused on protecting the natural environment and the planet.

FReD comprises six projects (two FIDES projects, two RESPECT projects, and two DEMETER projects). Some of them are short-term (year long) projects, some are medium-term (two-year long) projects, and some are long-term (three-year long or longer) projects.

Progress on the implementation of FReD projects is measured using a FReD index. It is calculated as an arithmetic mean of progress scores for all of the six projects. The index is calculated at the end of each year of project implementation.

CSR - our commitment to society and the environment

#mniejplastiku (#lessplastic)

In 2020, we made a commitment to stop using any single-use plastics. We launched our #mniejplastiku educational campaign to raise our staff’s and customers’ awareness of how harmful single-use plastics are to the environment. We also give tips on how to cut down the use of plastics in our daily lives. The objective of this campaign is to raise people’s awareness and change their lifestyles so that they choose to cut down plastic waste and to segregate plastic waste they do generate to be recycled.

We have partnered with the international Plastic Odyssey project as one of its sponsors to help solve the problem of plastic waste worldwide. The crew of a special laboratory vessel travelling along the coasts of Africa, Latin America, and Asia help local communities create recycling systems and convert plastic waste into useful reusable items.

We also engage in fighting plastic in Poland. We raise awareness of how harmful single-use plastics are during Dawid Podsiadło's concert tours, big outdoor events, such as the Baltic Odyssey, the Mountain Odyssey, the Vistula Odyssey, the Clean Oder Campaign, and other events.

We have also launched a mniejplastiku.pl website as part of the #mniejplastiku campaign, and an educational #mniejplastiku podcast available via all podcast players. We have staged an outdoor exhibition of photographs showing plastic waste, accompanied by educational information. We also display facts about plastics and tips on how to cut down their use on screens at the bank’s head office and in branches.

Zamieniam się w słuch (I’m All Ears)

One of our key commitments to society is to improve the standards of service for customers with hearing problems, change the way in which people with hearing loss are perceived, and integrate them into society. Since 2020, our comprehensive activities as part of the Zamieniam się w słuch (I’m All Ears) project have been focused on three areas:

- adjusting the infrastructure in bank branches to the needs of people with partial or complete hearing loss: installing induction loops and using the Polish Sign Language remote translation system;

- educating staff on how to provide comprehensive and respectful service to customers with disabilities;

- integrating people from different backgrounds, including by inviting people with impaired hearing to Dawid Podsiadło’s concerts and helping them enjoy the concerts by installing induction loops in the concert halls.

Our initiatives help prevent social exclusion and break down communication barriers, while at the same time improving the social sensitivity of the bank’s staff and promoting diversity in the workplace. Thanks to our efforts people can learn about the culture of the deaf and the about living in a 'world of silence’.

Partnership programmes

We are involved in a number of partnership programmes in the fields of corporate sustainability and ESG, including:

- Climate Positive programme of Global Compact Network Poland;

- Climate Leadership UN Environment (UNEP/GRID);

- Partnership Programme of Responsible Business Forum;

- Chapter Zero Poland - The Directors’ Climate Forum.

We also work with the French-Polish Chamber of Commerce (CCIFB), including on the Climate and CSR Committees, and with the Polish Bank Association (ZBP), including on the Sustainable Finance Committee. We are also a member of the CSR WroClub, a group of passionate CSR practitioners from Wrocław’s biggest companies.

If you want to learn more

We recommend a series of webinars entitled ‘Green revolution in business. What is ESG and what challenges does it pose to your business?’ we have organized for various groups of our stakeholders. The webinars focus on the basics of sustainable development and ESG:

- for our AGRI clients: TUTAJ;

- for our SOHO/SME clients: TUTAJ;

- for our suppliers: TUTAJ;

- for our business partners: TUTAJ.

Useful contacts:

- Corporate sustainability and ESG: Ewa Deperas-Jarczewska, Corporate Sustainability Team Manager, [email protected]

- CSR, our commitment to society and the environment: Przemysław Przybylski, Corporate Communication Office Director, [email protected]

2019

The year 2019 started very successfully for us. Our economists were again awarded in the ranking of macroeconomic indicators forecasts conducted by the Reuters news agency. A team of our economists: Jakub Borowski (main economist), Jakub Olipra and Krystian Jaworski, for the second time in a row took the 1st place. Our economists have been at the forefront of this ranking regularly since 2015.

In March we launched a helpline in Ukrainian. Apart from English and French, it is already the third language in which we provide a foreign language service for our clients. In the same month, the "Cash loan without commission" offered by us was ranked 1st in the ranking prepared by the FinAi platform. Thanks to low interest rate and APR and lack of commission, the offer turned out to be the cheapest among loans for 15 thousand PLN with a loan term of up to 24 months.

Also in March, we extended the BLIK mobile payment offer by adding the possibility of making transfers to the phone, also known as P2P (person-to-person). This is a convenient form of express payment, carried out only by using the phone number of the recipient of the transfer.

In 2019, we were again distinguished in the report "Responsible Business in Poland. Good practices". The latest report contains 23 good practices of our bank.

As in previous years, this year we were a strategic partner of the Coface Country Risk conference in Poland. This year's edition of the event was held under the slogan "Politics, economy, regulations - business under the pressure of change". One of the speakers was Jakub Borowski, our main economist, who gave a lecture entitled "Analysis and perspectives of the Polish economy with particular emphasis on the variants of the monetary policy reaction".

In the survey conducted by MillwardBrown in the first quarter of 2019, we are the second most recommended bank in Poland. Moreover, in this period 71% of clients transferring their accounts chose Credit Agricole.

In April, our mobile application CA24 Mobile was twice awarded: in the Golden Banker ranking and in Gazeta Bankowa's technology competition. In the Golden Banker we received the highest score in the category of ergonomics of mobile banking services. We were appreciated for the convenience and simplicity of performing the most frequently executed transactions in the application. During the TechnoBiznes Gala organized by Gazeta Bankowa, we received a Lider2018 award for biometric logging into CA24 Mobile, which we made available to our customers at the end of 2018.

On April 25th, as part of the Earth Week celebrated in our bank, our volunteers got involved in the cleaning of green areas in Wrocław. They invited the Wrocławskie Centrum Opieki i Wychowania to work together to clean the meadows and groves in its vicinity. We also took part in the Green Record of Poland by introducing large potted plants in our bank outlets.

In May, our team of economists was awarded again. Jakub Borowski, Krystian Jaworski and Jakub Olipra received the Top Forecasters award. Analysts took the first place in forecasting inflation and the second place in the general ranking. We also received the "Jedynka Wyborczej" - an award granted to 30 companies from Lower Silesia, which have been recognized as leaders of economic transformations in our region since 1989, and today belong to the leaders of business in their industries.

Once again, we have become a partner of the International Festival of French-Speaking Short Films in Zielona Góra. Our employees also took part in the 7th Company Run again. Our bank was represented by 25 teams, and our two women's teams stood on the podium in the classification of women's teams.

2018

Credit Agricole Bank Polska started the year 2018 very positively. Similarly to last year, we could be proud of the results of customer recommendations research. For the third time in a row, Credit Agricole was at the top of the ranking of the most recommended banks. In the MillwardBrown independent survey "Customers of banks in Poland 2017", the NPS (Customer Recommendations Index) for Credit Agricole was 49.1%. This is over twice as much as the average for the whole market (21%).

Clients not only willingly recommend us, but also transfer their accounts to us. Another year we are a leader in transferring accounts through the system of the Krajowa Izba Rozliczeniowa.

At the beginning of the year we also signed a contract with Bank Gospodarstwa Krajowego. We have joined the ecosystem of financial institutions that make it easier for entrepreneurs to conduct transactions with foreign contractors. Corporate clients can confirm with us export letters of credit for markets with higher risk, and Bank Gospodarstwa Krajowego will take over this risk.

January was full of awards for our economists. First, they were ranked among the best forecasters of economic trends in Poland. The ranking was prepared by the "Parkiet" daily. At that time, our experts turned out to be unrivalled in the category of GDP forecasting and retail sales. In the competition organized by "Rzeczpospolita" daily, in the category of one-month forecasts, Jakub Olipra was ranked 1st, while in the forecasts 3 months in advance he was ranked 2nd.

At the beginning of 2018 we started cooperation with one of the e-sport teams - we became the main sponsor of the young, dynamically developing Off-Mode team, which is achieving its first successes on the CS:GO scene.

In March we once again supported the Coface Country Risk, a conference focused on risks in commercial transactions and supporting the development and export of Polish companies. One of the speakers was Jakub Borowski, the main economist of our bank. We also supported cultural events. Our involvement in the Wrocław edition of the Days of Francophone Countries is a tradition. This initiative has been promoting French culture in Poland for 20 years. For the 14th time we were the patron of the festival.

Since mid-March, company customers and farmers have been able to use mobile application – CA24 Mobile. All customers have also gained access to new functions, e.g. checking the balance before logging in.

In March, using the funds collected during the Savings Week (we promised to donate five zlotys for charity for each deposit in the promotion), we bought books about saving and together with the Zaczytani.org Foundation we conducted a workshop on storytelling for the children of the Wrocławskie Centrum Opieki i Wychowania. We also opened the Reading Library (Zaczytana Biblioteka) there, and our employees conducted workshops on finances and saving for the youngest.

In April we launched a new media campaign "All the attention for you. A bank that listens attentively and delivers to its customers what they need". - This is how we want to be perceived by customers, how we want to act, how we want to create our offer and build long-term relationships. The main face of the campaign was Dawid Podsiadło. We also presented a new offer of personal accounts.

April was a month full of awards and distinctions for our bank: in the MP Power Awards® competition a series of events for students "Fresh blood for the first job" was awarded in the category of an educational company event; our TeleBot received gold in the Innovation 2018 competition in the category Media/Algorithms and Optimization Tools; moreover, in the report "Responsible Business in Poland. Good Practices" was awarded to 20 good practices of our bank.

In 2018, we once again became involved in helping Towarzystwo Przyjaciół Dzieci. Support for the "Help the Child" campaign allowed 500 children to spend their holidays in Jarosławiec, Rewal and Łukęcin during health and rehabilitation vacations.

In June Focus Economics appreciated our analysts. Team of our economists: Jakub Borowski, Krystian Jaworski and Jakub Olipra won in terms of accuracy of EUR/PLN exchange rate forecasts and ranked third in the general classification of macroeconomic and market indicators forecasts for Poland.

In the same month, the installment loan offered by us was awarded the golden emblem of the Consumer Quality Leader (for the second year in a row), and in the prestigious competition of the marketing industry Golden Arrow 2018 we won two awards - we were appreciated for innovative solutions (pre-rolls) used in the campaign Accounts for You with David Podsiadło and our TeleBot. In June, we also took 3rd place in the "Best Bank 2018" competition in the category of small and medium-sized commercial banks in a plebiscite organized by Gazeta Bankowa.

In August, our economists were once again appreciated. They took the 1st place in the ranking of macroeconomic indicators forecasts conducted by the Reuters news agency. Last year our experts took the 2nd place in this ranking, and two years ago the 1st place.

Employees of our bank have become involved in a charity initiative "Buy a backpack for a child", which consists in preparing school kits for children from Lower Silesian orphanages and foster families.

August is also the month in which we published the first non-financial data report of our bank. We have collected all the activities related to Corporate Social Responsibility (CSR) at Credit Agricole.

In 2018, for the fifth time, we organized Credit Agricole Day in all branches in Poland, during which bank employees go out to customers and meet them at specially organized events. This year's edition was held on 6 September under the theme "Benefits Festival" and was addressed to whole families. Customers opening our "Account for you" or "VIP Account for you" could choose one of the benefits: 100 or 200 PLN for the account transfer, 300 PLN for the return of bills or 300 PLN for the CASaver bonus.

At the beginning of October the MAXIMUM Program was launched, which is a continuation of the project "Fresh blood for the first job". The program aims to support young people in their first professional steps and to help them discover their own potential. In this edition, until the end of November, our bank visited 13 universities in 9 Polish cities to show students that they can do more with us. In the same month, the PowerOn Wellbeeing Program implemented in our bank since April was awarded in the national WellPower 2018 competition.

In November, the Board of Executives of our bank changed - Damian Ragan replaced Richard Paret as Vice-President of the Board of Executives.

In cooperation with the Dotlenieni.org Foundation, in mid-November our volunteers planted trees and bushes (a total of 130 seedlings) in the area belonging to Wrocławskie Centrum Opieki i Wychowania, with which we have been cooperating since last year.

At the VI edition of the CESSIO Laurel organized on 19 November, our bank won the second CESSIO prize in the Banking Sector category. This is the most prestigious award in the field of credit management granted in the voting of companies associated in the Polish Financial Supervision Authority (KPF). This is the fourth CESSIO award for our bank. Previously, we were awarded in 2013-14 and 2016. The highest quality and diligence in the sales processes carried out by the bank were appreciated in all editions.

Also in November we received three prestigious awards in the competition "Kreatura 2018" for the campaign with David Podsiadło: special award "for mastering the video format of the future" in the category FILM-VIDEO IN THE INTERNET, award for the whole campaign "Careful Bank" and "Account for You" in the category CAMPAIGN and additionally a distinction in the category FILM-VIDEO ON THE INTERNET.

We were also noticed in the MIXX Awards 2018 competition organized by IAB Poland. The campaign of the account with David Podsiadło (categories Brand Awareness and Positioning and Cross Media Integration) was awarded with silver award, and our innovative TeleBot (Innovation category) was awarded with bronze.

The beginning of December welcomed us with new awards. Since 2013, our Contact Center has been on the podium of the best banking hotlines. This year, we were ranked 3rd in the most prestigious and comprehensive survey of banking hotlines in Poland, conducted by the ARC Rynek i Opinia Research Institute. We also received a Silver and Bronze Paper Clip in the most important industry public relations competition in Poland. Our informational and anti-crisis campaign in Copernicus program (concerning a major technological change, which significantly simplified the architecture of IT systems) was appreciated.

Also in December, our bank received a certificate which classified us as one of the Pearls of the Polish Economy in the category of the financial sector. The ranking is published annually by the editors of the economic magazine "Polish Market". The jury of the competition honoured us for consistent implementation of the company's policy and strategy and for our leading position among the most dynamic and effective companies in Poland.

Also this month, the CEO of our bank, Piotr Kwiatkowski, officially signed the Diversity Charter - an international document promoting diversity and equal opportunities in the workplace.

December 19 the District Court for Wrocław-Fabryczna in Wrocław registered the increase in the share capital of Credit Agricole Bank Polska S.A. Currently, the company's share capital amounts to PLN 830,633,400.00.

At the end of the year, the employees of our company for the 13th time joined in the eighteenth edition of Szlachetna Paczka and helped those in need. Moreover, four trainers of our bank shared their competences with nearly 50 participants of the Municipal Volunteer Days in Wrocław. It was already the eighth edition of this event promoting employee volunteering.

2017

In early 2017 Credit Agricole Bank launched a refreshed version of its logo. Our Polacy wybierają Credit Agricole (Poles Choose Credit Agricole) campaign, encouraging people to switch accounts and transfer them to our bank, was the first opportunity to roll out the new logo.

Our economists were recognised as the most versatile economic analysts predicting future trends in Poland. The team, led by Jakub Borowski, won the Macroeconomic Factors Forecasts category, and topped the ranking of the most versatile analysts predicting future developments in 2016.

Credit Agricole achieved the highest score of all banks in Poland in a customer satisfaction survey carried out by TNS Polska. We ranked first in terms of customers’ referrals. Besides that, we were also given a high overall rating, and respondents appreciated the friendliness and expertise demonstrated by our staff in branches and on the infoline, as well as the safety of our electronic banking transactions.

In February we launched our company blog. CAsfera.pl is a portal created by Credit Agricole Bank staff members. We write about finances, careers, hobbies and interests, as well as something we especially appreciate - human relations.

Once again we came first in the consumers’ referrals ranking published by independent institute Millward Brown. In the fourth quarter of 2016 we hit an all-time high on the CRI index: 67.6. We also carried out an image campaign targeting young people. We invited two popular YouTubers, Stuu and Izak, to take part in it.

In early March we launched our Kredyt gotówkowy od eksperta (Cash Loan from an Expert) campaign, with Bank staff members fronting the campaign. Also in March we celebrated the Francophonie Days in Wrocław. It was our thirteenth time as a partner in the event. Furthermore, we launched a new mortgage loan sales process with the possibility of issuing credit decisions in as little as 24 hours.

In March we also received our second Brązowy Dudek (Brown Hoopoe) certificate for participating in a CSR programme organised by Ekoaktywni.com. The Hoopoes are awarded to companies that send the most documents for recycling to the programme organiser. In the same month 10 practices carried out by our Bank were distinguished in the Responsible Business in Poland 2016 report, published by the Responsible Business Forum.

In March the District Court for Wrocław-Fabryczna issued a decision concerning an increase in the share capital of Credit Agricole Bank Polska S.A. to 699,000,000 zlotys. The share capital was paid up in full. Dziennik Gazeta Prawna published its 11th Ranking of Responsible Companies, with our Bank ranking sixth at the “crystal level”, having been classified as an active and CSR-mature company. The Bank’s offering was expanded to include loans granted via the quick e-Sales process to customers running small and medium-sized enterprises.

In June Credit Agricole Bank Polska came first in the 13th customer service quality survey of bank call centres carried out by Instytut Badawczy ARC Rynek i Opinia. Also in June, the 4th Regional Business and Entrepreneurship Fair was held in Ostrów Wielkopolski. Visitors appreciated our presence at the event: we received a prize for the best stand.

In mid-June we merged several IT systems into one. Thanks to those changes we will be able to launch and develop new products and services more quickly.

On 21 June we organised the fourth annual Credit Agricole Day in all our branches in Poland. This is a day when our bank personnel go out to meet customers at special events which are organised for that purpose. A similar event dedicated to the Credit Agricole Raty instalment loan offering was also organised in five Polish cities.

In July, a series of surprise events for our customers all over Poland was awarded a prize, having come third in a competition for the best communication projects run by the Credit Agricole Group, organized at the Paris-held Com 400 conference. We launched the KrEdytka chatbot on Facebook Messenger, and thus became the first bank in Poland to make use of artificial intelligence to serve our Customers.

In August we made Silesian-dialect information leaflets available in branches in Upper Silesia and Opolszczyzna. Service in the Silesian language was also offered to customers in selected branches.

The Credit Agricole Raty offering was awarded the 2017 Golden Quality Leader title in a consumer survey organised by the editorial team of Strefa Gospodarki, which is a supplement in Dziennik Gazeta Prawna . Our Bank was distinguished for tailoring its offering to customer needs, among other things. It also turned out that the Credit Agricole Raty brand was known to as many as 70 percent of respondents, which was the highest score in the survey.

In September the bank’s Wrocław and Warsaw offices received a visit from Philippe Brassac, CEO of the Credit Agricole Group. During his visit Mr Brassac emphasised that Poland remained a very important and promising market for the Group.

In October the composition of the Management Board of the Bank changed. Mr Piotr Kwiatkowski replaced Mr Romuald Szeliga as President of the Management Board, and Mr Bartłomiej Posnow became a new Management Board member. Also in October we launched our Akcja Konsolidacja (Consolidation Action) promotion. As part of the promotion, customers were able to transfer loans taken out with other banks to Credit Agricole for no fee, and repay them in single instalments, lower than before, and obtain additional funds for their current needs at the same time. In the same month, in Kashubia, we made information leaflets available in the Kashubian language, and offered customer service in that language in selected branches.

In mid-November we launched an offer for Ukrainian citizens staying in Poland. At the end of November our commercial spot Szezlong (Chaise Longue), prepared by Just and featuring Karolina Gruszka, received a Kreatura 2017 award. The advert promoted free personal accounts with payment cards and free access to ATMs worldwide, and it was part of a campaign encouraging Poles to switch banks and transfer their accounts to our Bank.

2016

In January Credit Agricole’s Chief Economist, Jakub Borowski, was honoured to be selected as one of the best experts in forecasting FX rates in a ranking published by Rzeczpospolita . We became the first bank in Poland to implement a new, electronic method of signing instalment loan agreements outside branches, involving the use of text messages (with no need to send documents to the bank).

Credit Agricole signed an agreement to participate in BLIK - a system for mobile payments, which is planned to be implemented in early 2018. The range of insurance products offered by our Bank was expanded to include property insurance and personal third party liability insurance.

In February we promoted our Świeża Krew do pierwszej pracy (Fresh Blood: On Your Way to Your First Job) programme in collaboration with vloggers Arlena Witt and the authors of the Matura to Bzdura (The Matura Exam Is Rubbish) channel. The Bank received the Brązowy Dudek (Brown Hoopoe) certificate for participating in a CSR programme organised by Ekoaktywni.com. Also, a consumer survey found that Credit Agricole was the second best bank in Poland in terms of customer referrals.

The Francophonie Days were held in Wrocław. It was our twelfth time as a partner in the event. It was also in March that the biggest job fair in Poland (Career Expo) was organised in Wrocław. Credit Agricole participated in it for the first time. We were also present at the Spring Job Fair organised at the Wrocław University of Technology and the Wrocław University of Economics. In the spring of 2016 we launched another series of events at universities as part of the Świeża Krew do Pierwszej Pracy (Fresh Blood: On Your Way to Your First Job) programme. We visited as many as 10 of the largest university cities.

The Dzielimy się wiedzą (Share the Knowledge) project was included in the ranking of the ten best CSR initiatives in the entire financial sector, which was drawn up by Gazeta Finansowa in March. At the same time, the Responsible Business Forum published a report (‘Responsible Business in Poland 2015’), describing ten of our practices, including ‘Customer Education: Environmental Protection’, ‘Eco-Driving Training’ and ‘Rails for the Disabled in Bank Branches’.

For our customers’ greater convenience we began to offer instalment loans under a single brand ( Credit Agricole Raty ). Before that we had been using three brands, depending on the sales channel ( Credit Agricole Raty for the Internet, LUKAS Finanse for traditional stores and Crédit Agricole for high value loans).

On 8 April the Supervisory Board of our Bank officially appointed Mr Richard Paret and Mr Jędrzej Marciniak as Vice-Presidents of the Management Board. Also in April we launched a competition with financial bonuses for holders of Credit Agricole credit cards. The competition closed in June.

Starting from April, our customers were able to file applications for the 500+ child benefit using our CA24 Online Banking Service. For all parents who intended to regularly save the benefit (in full or in part) we prepared a special offer as part of the Moja Rezerwa Finansowa (My Financial Reserve) Regular Savings Programme, involving a bonus of up to 1,100 zlotys paid by the Bank.

Our team of economists, composed of Jakub Borowski (Chief Economist), Jakub Olipra and Krystian Jaworski, took 1st position in the ranking of macroeconomic factor forecasts carried out by the information agency Reuters.

In late April we launched our mobile application – CA24 Mobile . Our customers can use it to manage their personal accounts and credit cards, and they also have access to savings products.

In May the Crédit Agricole Group announced a new motto: ‘Toute une banque pour vous’ (‘A whole bank just for you’), which reflects our attitude to our customers: putting them and their needs first, demonstrating our commitment to ensuring that their needs are satisfied and our availability around the clock. In the same month our brand, Crédit Agricole, was awarded the title of Premium Brand 2016 .

In June we celebrated the third Credit Agricole Day – we ventured out of our branches to get even closer to our customers. In the same month we ended another school year of our social campaign Bank z klasą. Cała wiedza o bankowości (A Bank with Class: All You Need to Know About Banking). 40 volunteers finished teaching classes to over 1600 pupils in primary schools across Poland.

To celebrate Euro 2016 we offered our customers a Football Deposit, whose interest rate in three periods depended on the number of goals scored by our national football team in each game (only goals that allowed the team to win or draw were taken into account). Later we also added ‘Football Deposit – Quarterfinals’ to our offering, with an interest rate of 3.5%.

As a result of our partnership with Concordia Ubezpieczenia, at the end of June we introduced insurance products for farmers to our offering, including mandatory insurance policies, third party liability insurance, legal expenses insurance, life insurance for borrowers, and property insurance.

In mid-July another insurance product, Pakiet Turystyczny (Travel Insurance), was added to the Bank’s offering. The new insurance product ensures round-the-clock assistance in the event of an unfortunate incident abroad. In July Credit Agricole began to issue Visa Debit and Visa Business Debit cards, linked to business (SME) and AGRI accounts. The number of places in which the new cards are accepted is growing. The cards can also be used for online payments. In August we launched a service for business owners in branches that do not have business customer advisors.

In September the Bank received the BS 10500:2011 certificate, which confirms that the anti-corruption management system adopted by the Bank meets international security standards. The certificate was issued for 3 years. In mid-September we added accident insurance (NNW) for children to our range. On our website we also launched a page for farmers, where individual insurance products and the general terms and conditions of insurance are presented, and where customers can find out where they can buy insurance and how to report insurance claims.

In October our first bank stakeholder panel was held for the representatives of customers, authorities, social organisations, universities and business. One of the purposes of the panel was to gather opinions and learn about expectations towards the Bank with regard to its social role.

In November we sponsored an art project called ‘Lille meets Wrocław’. On our Facebook fanpage we published our first photo taken with the use of 360 degree technology. Even though Facebook had offered this possibility back in June, no other Polish bank had done it before us. In the same month we adopted the Code of Ethical Advertising. When preparing it, we focused on the needs of the recipients of our communications, and not just on banking procedures.

Two pilot branches, outfitted based on the opinions and comments of customers and bank personnel, were opened in Ruda Śląska and Kielce.

December began with two events: Credit Agricole’s Mastercard Credit Card Day and Credit Agricole Bank’s Open Day. Also in December we started our referrals programme ‘PoleCAm Biznes’ ( I Recommend Programme for Businesses). Customers who use our products for small and medium-sized enterprises can get a bonus of up to 300 zlotys for recommending those products to those they do business with. December was also the month when the results of the 14th bank contact centres survey, carried out by Instytut Badawczy ARC Rynek i Opinia, were announced. We came third in the overall ranking and our product knowledge proved to be the best.

We took part in the Szlachetna Paczka (Noble Pack) charity event for the eleventh time. We prepared over 80 packages for the 16th edition. At the end of the year we also organised the first three surprise events for customers in Malbork, Warsaw and Wrocław. We wish to enhance positive emotions through such events, and get even closer to our customers, building our mutual relationship.

2015

The Bank started 2015 with new promotions for Customers. Yet again a special offer was launched for Customers taking out instalment loans thanks to which one could get 10% of the loan instalment value back. The Bank also started a cash loan campaign, under which every PLN 1,000 cost the Customer as little as PLN 10. Also in January Credit Agricole offered deposits for funds from subsidy “Lokaty pod dopłaty” to its AGRI Customers, with an interest rate up to 4%. Under this product Credit Agricole let farmers close the deposit any time without losing interest or bearing additional costs.

Thinking about all those going for winter holiday and fans of skiing going abroad the bank prepared a promotion concerning cash withdrawal from ATMs all over the world without any commission. The Bank’s customers enjoyed free cash withdrawal until 1 March.

The beginning of the year was the time of ambitious plans for the Bank’s volunteers who began preparatory works in order to carry out 15 projects financed under the Bank’s grant programme. During the year volunteers got involved among other things in helping dogs in shelters, in rehabilitation of a 6-year-old girl and in organizing winter holidays for children coming from disadvantaged families.

Also in January the Bank adopted the Corporate Governance Rules for Supervised Institutions issued by the Polish Financial Supervision Authority (KNF). The Corporate Governance Rules define the internal and external relations of the Bank, including relations with the Bank’s shareholders and customers, organization of the Bank, the functioning of the Bank’s internal supervision and key internal systems and functions, as well as the Bank’s governing bodies and principles of their cooperation.

Towards the end of January the Bank launched the first property insurance product in the individual model: accident insurance Pakiet na Wypadki and assistance insurance Multipakiet Maxi. The sale of insurance products in the individual model means that one must hold a Certificate of Person Performing Agency Activities (OWCA Certificate) to be able to sell such products. At the same time the Bank completed its property insurance offer, which was part of the adopted bancassurance strategy involving making banking and insurance products available ‘under one roof’ at Credit Agricole.

February saw the launch of our cash loan TV campaign with Juliette Binoche, who also encouraged customers to open accounts at Credit Agricole later on.

Also in February we learnt that Jakub Borowski (Credit Agricole’s Chief Analyst) had been the most commonly cited bank economist in Poland in 2014. In that year his comments were published as many as 657 times in the media.

In March the Bank was promoting French culture in Wrocław during the Francophonic Days. It was the eleventh time that the Bank offered its support for this festival.

Credit Agricole presented its offering to farmers at the AGROTECH Agricultural Machinery Show in Kielce, where it presented financial solutions for agriculture: from Agricole account to investment loans and savings. March also saw the beginning of another edition of the ‘Are You Ready for PLN 1000?’ accounts campaign, which lasted until the end of May. The campaign turned out to be an immense success: over 80 percent of applications for transfer of account from another bank in May were the applications for transfer of an account to Credit Agricole. As many as 7 out of 10 accounts transferred from other banks in H1 2015 were transferred to Credit Agricole.

During the school year the Bank’s volunteers were carrying out the ‘Bank with Class’ programme in primary schools. 65 volunteers were teaching the basics of finances to nearly 2,380 children from 50 schools all over Poland.

In April as many as six corporate social responsibility (CSR) initiatives of the Bank were recognized by the Responsible Business Forum in its ‘Responsible Business in Poland 2014. Good Practices’ report. Among these initiatives were educational projects for local communities, responsible purchasing policy, installing defibrillators and employee volunteering programme.

Also in April the Bank adjusted its operations to Recommendation U issued by the Polish Financial Supervision Authority by selling insurance products in the individual model. In the Golden Banker 2014 competition organized by Bankier.pl, Credit Agricole ranked second and third in the Best Cash Loan (for its SIMPLY-CALCULATED loan) and the Best Loan for Business Undertakings (for its 3x0 Working Capital Loan for Business Undertakings) categories respectively.

In May Credit Agricole launched a promotion of accounts for young customers (I Recommend the 1st Account – Extra), offering customers a bonus of up to PLN 600 for active use of accounts and recommending the account to friends.

In 2015 the Bank focused on the development of the network of partner branches (franchise branches and credit agents). From the beginning of the year the Bank opened 60 new credit agencies. In the past credit agents and partner branches offered cash loans, credit cards and group insurance products only. Since mid-2015 it is possible to open accounts and deposits in partner branches.

In June the Bank celebrated the Credit Agricole Day in all branches in Poland for the second time, offering a lot of attractions to customers. The customers were presented offers containing preferential terms, and they were able to meet with the Bank’s Management Board Members in branches.

In June two employees of the Bank’s Call Center reached the final round of the Telemarketer of the Year competition organized by the Call Center Group of the Polish Marketing Association SMB. The jury had heard 1,064 conversations of call center employees.

In 2015 the Bank also organized another edition of the ‘Fresh Blood. On Your Way to Your First Job’ programme aiming to help young people take the first steps on their professional career paths. The Bank intends to help candidates to reach agreement with potential employers, and to show what the recruitment process looks like in practice. Young people taking part in the programme can test themselves during mock job interviews carried out by experienced recruitment specialists.

In the same month Credit Agricole’s mortgage loan was recognized by the Polish magazine Wprost. Among other things, the jury paid attention to brand awareness, the level of adjustment of the offer to market needs, the transparency of the offer, fees and charges, customer service quality and the loyalty policy.

In July Krystian Jaworski, an economist from the Macroeconomic Analysis Department of Credit Agricole won a competition organized by Obserwator Finansowy, having presented his original ideas for changes to the public finances. In the summer, the Bank once again launched a promotion for customers going abroad: until the end of September they were able to withdraw cash from ATMs all over the world without a fee.

In August the Bank reduced the interest rate for the cash loan to 3 percent. The reduction was supported by an unusual advertising campaign We Reduce the Interest Rate in Grand Style! During the campaign the display windows of Credit Agricole’s branches called passers’-by attention thanks to an original form of outdoor advertising: a black, convex wrecking ball with a red inscription on it, which looked as if it had been a real ball thanks to using a ‘broken glass imitation’ technique.

Phillipe Marié’s nearly six-year term of office as Vice-President of the Management Board and Senior Country Officer of Credit Agricole Bank Polska came to an end in August. In September the position was taken over by Olivier Constantin, who has had nearly 30 years of experience in banking. In September Credit Agricole took part in the activities connected with the European Sustainable Transport Week. The Bank promoted ‘green’ forms of transport (public transport, bikes and walking) among its employees.

In October the Bank launched its offer of EUR, USD and GBP accounts for business customers. Also in October the Bank once again organized the Account Day, which achieved a huge popularity among customers.

2015 was the year of low interest rates, but Credit Agricole offered high interest on deposits to its customers. The Bank’s annual and monthly deposits ranked second and third respectively in the ranking prepared by TotalMoney.pl.

In November the Bank offered the cash loan with a favourable interest (5.9%). In December Credit Agricole ranked second in the Bank Call Centers Survey organized by Instytut Badawczy ARC Rynek i Opinia. The survey assessed the customer service quality in the telephone and e-mail service.

Before Christmas the Bank prepared special offers for its customers in the Credit Agricole Discount Club, allowing them to save a lot on Christmas shopping. Credit Agricole’s cash loan ranked first in the Christmas cash loans ranking prepared by Bankier.pl.

Also in December the Bank was helping the disadvantaged as usual, and took part in the nationwide Noble Pack action for the tenth time. In 2015 the Bank’s employees offered Noble Packs to 25 families all over Poland.

2014

For the upcoming Christmas Credit Agricole’s Discount Club invited customers to take advantage of pre-Christmas promotions in December. The Bank also encouraged customers to do their shopping online, and take out instalment loans to finance the purchased items. As usual, towards the end of the year the staff of Credit Agricole Bank once again supported pre-Christmas initiatives to help those in need. This time, they joined the Christmas Food Collection campaign and - for the ninth time already - the nationwide Noble Pack campaign.

In November the Bank offered customers cash loans on special terms once again. Early in that month the Bank launched a pre-Christmas cash loan campaign. Credit Agricole used a proven solution and launched another PLN 10 Simply-Calculated Loan promotion.

In November Credit Agricole also encouraged the existing and potential credit card holders to take part in the Pay with Card and Win! competition. The most active participants had a chance to win one of forty Apple products.

In October, the bank launched its autumn promotional campaign targeted at people aged from 18 to 27, offering them free-of-charge bank accounts and attractive discounts as part of the Discount Club programme, and inviting them to attend educational meetings at universities and to participate in a Career Hacking competition.

In October, Credit Agricole also prepared a promotional offer for licensed petanque players and for clubs which are members of the Polish Petanque Federation. The Bank has been promoting this French sport in Poland for two years and wants to take care of petanque players’ finances.

In September, Credit Agricole invited farmers to visit the AGRO SHOW, the largest outdoor agricultural exhibition in Europe that had been organized in Bednary near Poznań for 16 years, and to attend the 12th Milk Cooperatives Forum in Augustów.

The bank, encouraged by the success of the first edition of the We Are Ready! promotional campaign for accounts, has decided to repeat it. Any person who between 28 September and 30 November 2014 opened an account with Credit Agricole could get a bonus of up to PLN 1000. All requirements that had to be met by the customer to enjoy the bonuses offered by Credit Agricole Bank were related to daily banking.

At the end of August, Credit Agricole invited young people who are planning or beginning their professional career to take part in a Career Hacking competition; the winners were announced in October. Twenty finalists will be offered an opportunity to test their professional skills working on case studies during workshops to be held in Wrocław. Then, five winners will be selected, who will go on a six-day educational trip to Paris.

In mid-August the bank offered cash loans on special terms. Credit Agricole decided to use a proven solution and to launch another PLN 10 Simply-Calculated Loan promotion. As indicated by the name of the promotion, the monthly cost of a loan was just PLN 10 for each PLN 1000 borrowed.

In August, Credit Agricole also launched a new Website of the Discount Club. Now, users of the bank’s payment cards can easily and quickly plan their shopping trips and calculate how much they can save if they pay with a card. The new feature allows the card user to do that either at home or in the shop, using a smartphone or a tablet.

At the same time Credit Agricole’s offering for businesses was expanded to include POS terminals. POS terminals are offered together with business accounts with no maintenance fee. No rental fee is charged for a POS terminal for three months. The POS terminals offered can be used not only for accepting card payments, but also for mobile phone top-ups and for loyalty programmes for customers of a shop or patients of a medical practice.

At the beginning of August, the bank launched an information campaign under the slogan ‘Insurance to Your Advantage’ aimed to remind the public that Credit Agricole offers its customers both banking and insurance products. Based on an analysis of benefits paid to its customers, the bank modified its life insurance package as a result of which the solutions offered accommodate the needs of customers taking out insurance to a fuller degree.

In July, the bank launched an information campaign under the slogan ‘Insurance to Your Advantage', aimed to remind the public that Credit Agricole is a universal bank that offers its customers both banking and insurance products.

At the end of June, Credit Agricole started a promotion for 1st Accounts and SIMPLYsaving PLUS accounts, under which between 27 June and 30 September 2014 holders of those accounts can withdraw cash from ATMs abroad free of charge, using the bank’s cards denominated in Polish zlotys, euros, or US dollars.

At the beginning of summer, Credit Agricole offered its account holders six-month deposits paying interest at 3.3 percent per annum. At the same time, the bank launched a promotion for six- and nine-month deposits offered to new customers who decide to open personal accounts with Credit Agricole and undertake to make regular payments into their accounts.

In June, the bank offered businesses a Business Account overdraft promotion. Under the promotion, the bank offered to set up one-year overdrafts free of charge, no fee for the renewal of such overdrafts, and no account maintenance fee throughout the duration of such an overdraft.

Also in June, Credit Agricole launched a mentoring programme under the name ‘On Your Way to Your First Job’. The bank invited ten experts, specializing in psychology, journalism, management, marketing, law, running own business, personal style, corporate finance, HR, and customer service, to participate in the project. On their Facebook fan pages, the mentors share their experience and professional achievements, ask questions, and encourage discussion. The underlying idea is to unleash young people’s motivation to act and encourage them to take the first steps on their professional career paths.

In May, Credit Agricole made efforts to convince the young that holding a personal account with the bank pays off and to encourage people aged between 18 and 27 to open their 1st Accounts. Any such young person who chose to do so at that time could receive a bonus of up to PLN 290 or an overdraft or credit card limit of up to PLN 1,000.

IMPLYsaving account packages were once again used by Credit Agricole to strengthen its position as a universal bank. In April 2014, the We Are Ready! promotional campaign was launched. Any person who opened an account with the bank until the end of May could receive a bonus of PLN 1000.

Also in April, Credit Agricole made available the CA Navigator application on its Website that can be used by any person interested in entrusting their savings to the bank to define their goals and choose products offered by the bank that will help the person to save money to achieve those goals. The system suggests products that meet the needs of the customer and enables the customer to compare, save, and view simulations.

In March, Credit Agricole presented its offering to farmers at the AGROTECH Agricultural Machinery Show in Kielce.

In February, the bank raised the interest rate offered for 36-month deposits up to 4.1 percent per annum despite the low interest rates prevailing in the market. The Credit Agricole offer was one of the most attractive ones in the market at that time as customers could open deposits without having to meet any additional requirements. In the same month, the bank started to sell InvestMedica.

At the end of January, Credit Agricole decided to offer holders of 1st Accounts and SIMPLYsaving PLUS accounts free-of-charge ATM cash withdrawals across the world, available in February and March, the months when most Poles take their winter holidays, many of them going abroad.

Also in January, the bank announced the launch of its cooperation with John Deere. Credit Agricole is the only bank in Poland that offers to finance purchases of machinery and equipment under the John Deere Financial programme, available to customers of authorized John Deere dealers only.

At the beginning of 2014, Visa debit cards, fixed term deposits and savings accounts denominated in euros and US dollars were made available to Credit Agricole customers.

In January, Credit Agricole launched another regular savings programme, in addition to My Financial Reserve, under the name ‘My Home’. This time the bank encourages saving for down payments.

2013

In December 2013, i.e. two years after the launch of Credit Agricole Discount Club the number of commercial outlets offering discounts to bank customers has exceeded 10,000. Thus, as the bank projected in 2011, the club has become the largest of its kind in Poland.

At the end of the year Credit Agricole introduced an investment loan for purchase of arable lands and agricultural properties to its offering. The product is intended for farmers who have been conducting agricultural business or manufacturing activity for at least 12 months, and they own or hold the land on lease.

In October 2013 the bank launched its new website based on the responsive web design technology. Thanks to complete information about products and the opening up to mobile users, the website makes it easy for users to familiarize themselves with the products and services offered by Credit Agricole and make an online purchase decision. The size of the screen used by a user is no longer important as the layout is adapted to the screen being used.

In September Credit Agricole made interest on standard offering deposits even more attractive. The Bank increased interest on 12-month and 24-month deposits. The annual interest rate was set at 3.20% and 3.75% for the 1-year and the 2-year deposit respectively, and was counted among the most attractive rates on the market. Staying true to our motto "Simply and Sensibly" we have prepared the offer for all customers, and there were no additional eligibility requirements.

Also in September the bank organized a panel discussion: Infrastructure Financing - Politics or Business? Among participants in the discussion held on 4 September 2013 during the 23rd Economic Forum in Krynica Zdrój were Jan Krzysztof Bielecki - President of the Economic Council of the Prime Minister, Paweł Tamborski - Undersecretary of Statein the Ministry of State Treasury and Régis Monfront - Vice-President of the Management Board of Crédit Agricole Corporate and Investment Bank. The discussion was chaired by Jakub Borowski, Chief Economist of Credit Agricole Bank Polska S.A. Among other things, the participants tried to answer the questions concerning profitability criteria and the impact of central and local government bodies on business effectiveness of infrastructure projects.

Regular savings programmes are a new product category introduced by Credit Agricole in August 2013. The first product from this category is My Financial Reserve which makes it possible to accumulate so called “just in case” funds. To support its customers in achieving this goal the Bank rewards them with extra interest for saving regularly.

In June the Crédit Agricole brand reported its all time high in terms of aided brand awareness (nearly 90 percent). Furthermore, 50 percent of respondents considered Credit Agricole to be a trustworthy financial institution. Intensive marketing activities, which have been carried out since the brand debut on the Polish retail banking market in September 2011 allowed the bank to get such good results.

Also in June Credit Agricole offered group insurance ‘Multipackage’ to its account holders, which was prepared in cooperation with TU Europa S.A. and Europe Assistance Polska S.A. and comprised three packages: Technical Assistance, Medical Assistance and Safe Pocket.

In May Credit Agricole started subscription to TOP 100 DIVIDEND.

In April the bank launched another product for farmers: an investment loan for purchase of arable lands. Customers who intend to start agricultural activities can also take out this loan.

On 22 March 2013 the General Meeting of Shareholders of Credit Agricole Bank Polska approved the bank’s financial statements and decided on how to distribute the profit for 2012. Shareholders were paid dividends amounting to three-fourths of the profit, whereas the remaining one-fourth was used to strengthen the bank’s equity.

In March 2013 Credit Agricole offered farmers the AGRICOLE account with a simple table of fees and charges. The account is maintained for free, and the most popular banking operations cost PLN 0 or PLN 1.

February was the month in which the Bank intensively promoted the Simply-Calculated Loan.

Also in Q1 2013 SIMPLYsaving Account packages were used by Credit Agricole to strengthen its position as a universal bank. At the beginning of 2013 the bank was encouraging its customers one more time to take its offer by offering them a reduction of payments for utility bills by 10% and a bonus if they decided to take the Round-Up Savings (CAsaver) service.

In January 2013 the Polish Financial Supervision Authority gave its consent to the merger of Credit Agricole Bank Polska S.A. with Credit Agricole Corporate and Investment Bank S.A., Branch in Poland. With this merger a business model was created under which both transaction banking products and investment banking products are offered to corporations. Additionally, thanks to the extensive retail sales network and the corporate centers being established, the bank’s services will be more accessible to customers.

2012

In February Credit Agricole Bank Polska received the Golden Banker statuette, in the third edition of the poll organized by bankier.pl portal and PAYU S.A. Internet users awarded the Bank with this honourable distinction for its Simply Calculated Loan.

With spring Credit Agricole Bank Polska entered the agribusiness market. Mobile advisors convinced farmers to take advantage of the Bank’s offer, and of the investment loan in particular. In developing the relationships in the new segment and in building its product offering the Bank draws on the competence and experience of Crédit Agricole regional banks - they form the biggest agriculture bank in France, which has been in operation for over 100 years and serves over 84 per cent of farmers in that country.

In March, the Bank reached out to SOHO businesses with an offer of financing new and used vehicles, equipment and machinery up to as much as 100% of the investment value. Credit Agricole offered them a flexible payment schedule tailored to their credit capacity and seasonal character of their business.

On March 26 the Supervisory Board of Credit Agricole Bank Polska decided that Romulad Szeliga would head the Management Board for yet another 5 year term commencing 1 September 2012. The Supervisory Board underlined the enormous contribution of the President in the development of the Bank and the fact that his education and professional experience guaranteed prudent and stable management.

Romuald Szeliga has been involved in banking almost from the very start of his professional career. During more than 20 years of his work in domestic financial institutions he took an active part in the development of standards and solutions for the entire banking sector in Poland.

The 10th, jubilee, edition of the report "Responsible Business in Poland. Best Practices" recognized Credit Agricole Bank Polska with four awards. Among the practices awarded were: the Active Center, the Let's share knowledge programme, the Code of Ethics, and cooperation with the University of Economics in Wroclaw.

In April, Credit Agricole Bank Polska offered all those interested in purchasing a car, especially in the pre-owned market, the Fast Car Loan. The new product was an addition to the Bank Car Loan already offered by Credit Agricole. The customer can now choose whether to use the traditional bank offer with its good price, possibility of obtaining a higher loan amount and longer financing period - but with security established on the vehicle, or the Fast Car Loan, with funding available almost immediately, without further formalities, with the possibility to benefit from reduced interest rates.

In May, Credit Agricole prepared a deposit lottery for its customers, in which the lucky winners could receive the equivalent of the savings that accumulated in the bank. Funds in I Save savings accounts, Antidotum PRO insurance and savings policies and fixed-term deposits were eligible for the promotion. To qualify for the lottery it was enough to have one thousand PLN gathered in all of these products or in any one of them on the eve of the draw. Every winner received from the Bank as much as they saved but not more than PLN 50,000.00. The total prize pool was nearly PLN 1.5 million, which is almost 100 times more than the average balance of savings in the products included in the lottery.

At the beginning of July Credit Agricole introduced a new investment product. The underlying product for potential profits of up to 30% within three year is the value of three indexes. World Indexes is an investment vehicle in the form of life insurance with unit linked insurance plan based on the value of three stock market indexes: WIG 20, S&P BRIC 40 Euro and SX5E (Euro Stoxx 50).

At the end of the month the Bank announced that it had once again invited Juliette Binoche to participate in its image building campaign. The decision to continue cooperation with the French actress was due to the success of the first image building campaign she participated in. Studies confirmed that customers viewed her positively as the ambassador of Bank brand. Thanks to intensive communication activities, over 76% of respondents declared recognition of the Credit Agricole brand.

In August, Credit Agricole Bank Polska introduced the Business Loan offer for representatives of liberal professions, which could be used for financing anything related to their business activity. Also existing SME customers could apply for the cash loan.

In October, the Bank offer was expanded with new packages of SIMPLY Saving accounts. Free online transfers, a Personal Overdraft Facility, contactless cards, a service which facilitates saving - are all components of the packages. The bank addresses the latest offer both to customers who use their accounts actively and expect tailored solutions and to those who use their accounts occasionally, but value personal contact with the advisor.

At the same time Credit Agricole introduced a new functionality - Round-Up Savings.

It allows customers, little by little, to put aside some specified amounts. All non-cash transactions made with any card issued to new account packages are rounded up and the round-up amount is transferred to the I Save savings account. Customers themselves decide the nearest round-up amount - it can be PLN 0.5, PLN 1 or PLN 5.

Introduction of new packages was accompanied by the I Save On Bills promotion addressed to those who opened a SIMPLY Saving PLUS or SIMPLY Saving PREMIUM account before November 30. During the campaign the Bank lowered account holders’ water, electricity, gas, internet, and mobile and landline phone bills.

In November, Credit Agricole announced that it would soon provide services to the largest corporations. The Bank will merge with the Polish branch of the corporate and investment banking arm of its shareholder. This is another considerable step on the way to universal banking. The Bank is waiting for the KNF consent to go ahead with the merger. The Bank expects the formal merger process to be completed in the first half of 2013. Also in November, Credit Agricole simplified the account opening process for corporate clients. They can now open an account using electronic documents, which will then be verified by Bank employees online in relevant registries.

2011

In January LUKAS Bank starts the refurbishment of its bank branches. The first ones are branches in Warsaw, Poznań, Katowice and Wrocław. The refurbished outlets feature both new external design (furniture, customer service stations) and overall organization of work of advisors. The refurbishment is a part of a larger project aimed at introducing a new model of work in all LUKAS Bank branches in Poland. By the end of the year the bank plans to refurbish all branches.

For the first time in the Bank’s history its offering features structured products. Up to 10% of annual profit is promised by Lukas Bank from its new guaranteed capital investment product launched in March. The condition for generating such profit is a stable, within a specific bracket, EUR/PLN exchange rate over the period of 2 years.

In April the bank launches services to corporate clientele.

In May LUKAS Bank promotes its cash loan by clearly communicating the associated costs. The Bank asserts that every Customer can easily calculate the costs of a loan. The offer is supported by a TV commercial.

On 23 September, LUKAS Bank S.A. changed its name to Credit Agricole Bank Polska Spółka Akcyjna and launched the Crédit Agricole brand for retail banking in Poland. The change of our name emphasises the fact that for 10 years we have been part of Crédit Agricole, one of the largest financial groups in the world. All our efforts are designed to make our bank even more credible, accessible, professional and friendly towards Customers.